| |

Projects

British Columbia

Introduction:

Canarc’s core asset is the 100% owned, past-producing, high-grade, 1.1 million oz New Polaris gold mine project located in north-western British Columbia.

Location and Access:

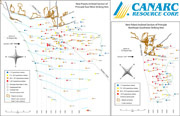

The New Polaris project is situated in northwestern British Columbia, 100 km south of Atlin, B.C., and 60 km east of Juneau, Alaska, on the west bank of the Tulsequah River near the B.C. - Alaska border.

Small aircraft carrying personal and/or supplies can reach the site from Atlin or Juneau. Heavier mine equipment and supplies can be barged to the minesite via the Taku River.

Ownership:

Canarc holds a 100% interest in 61 crown granted mineral claims and 1 modified grid claim totaling 2,956 acres. The project is subject to a 15% net profits interest to Rembrandt Gold Mines, which can be reduced to 10% NPI. For 150,000 shares.

Current Status:

Canarc is now considering a feasibility work program to include 15000 meters of infill drilling to upgrade inferred resources, to measured and indicated resources, mine and plant engineering, environmental permitting and completing a feasibility study at an estimated cost of CA$9 million, subject to financing.

Economics:

Canarc updated its positive preliminary economic assessment of New Polaris in April 2011 for the construction of 72,000 oz per year high grade, underground gold mine. Click here to view.

In the new base case preliminary economic model, higher gold prices appear to have a significant positive impact on the New Polaris gold mine project economics. Using new parameters for the gold price ($US 1,400 per oz), $CA /$US exchange rate (1.00) and cash costs (US$481 per oz), the updated Moose Mountain PEA generates a discounted (5%) after-tax Net Present Value ("NPV") of CA$195 million with an after-tax Internal Rate of Return ("IRR") of 42.8% and a 1.9 year pay-back period. On a pre-tax basis, the undiscounted life-of-mine cash flow totals $272 million.

Mining History:

Prospectors discovered gold at New Polaris in 1929. The mine, then known as Polaris Taku, was built in 1937 and commissioned a year later. It operated until 1942, shut down due to World War II, and then restarted in 1946 and operated until 1951. In 1951, a barge loaded with gold concentrate sunk off of the coast of BC in a violent storm. As a result the mine closed. Cominco owned and operated the nearby Tulsequah Chief and Big Bull deposits and in 1952 leased the site Polaris-Taku site and upgrade the mill to process ores mined from these deposits. This continued until 1957. During the mines operation, a total of 232,000 oz. gold was produced from 691,000 tonnes of ore grading 11.9 grams per tonne (0.35 oz./ton). Gold concentrates were shipped to a smelter in Tacoma, Washington for refining. About 15,796 m of under-ground development on 10 levels, and 3,747 m of raise development were completed at New Polaris. The deepest level of the mine is 187 m below sea level. A 250 m internal winze was used to haul ore to the main haulage access level. Mining methods included long-hole, shrinkage and resuing.

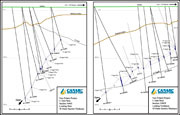

New Polaris then lay dormant for 30 years until exploration resumed in 1988. Canarc acquired New Polaris in 1992 and since has drilled 241 holes totaling 64,000 m of core, outlining significant new ore below and beyond the old mine workings.

Resource (NI 43-101 compliant)

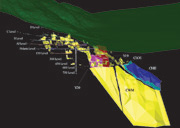

Updated February 1st 2007, and using a 6 gram per tonne cutoff (0.17 oz per ton), the total resource at New Polaris is 1,155,000 oz gold contained within 2,916,000 tonnes of mineralized vein material at an average grade of 12.3 grams per tonne (0.36 oz. per ton). Greater than 95% of the measured and indicated resources are located within the C vein system where infill drilling programs were conducted over the past three years. Approximately 75% of the inferred resources are also located within the C vein system, with the remainder attributable to the Y19 and Y20 veins. See the tables below for the breakdown of the resource categories.

|

MEASURED UNDILUTED RESOURCE

|

|

|

|

Cutoff Grade

|

Mineralized Tonnage

|

Average Grade

|

Contained Gold

|

|

(g/tonne)

|

(oz/ton)*

|

(tonnes)

|

(tons)

|

(g/tonne)

|

(oz/ton)

|

Au (oz)

|

|

|

|

|

|

|

|

|

|

2

|

0.058

|

390,000

|

429,902

|

9.48

|

0.277

|

119,000

|

|

4

|

0.117

|

330,000

|

363,763

|

10.62

|

0.310

|

113,000

|

|

6

|

0.175

|

271,000

|

298,727

|

11.89

|

0.347

|

104,000

|

|

8

|

0.233

|

203,000

|

223,769

|

13.54

|

0.395

|

88,000

|

|

INDICATED UNDILUTED RESOURCE

|

|

|

|

|

|

|

|

Cutoff Grade

|

Mineralized Tonnage

|

Average Grade

|

Contained Gold

|

|

(g/tonne)

|

(oz/ton)*

|

(tonnes)

|

(tons)

|

(g/tonne)

|

(oz/ton)

|

Au (oz)

|

|

|

|

|

|

|

|

|

|

2

|

0.058

|

1,280,000

|

1,410,960

|

10.97

|

0.320

|

451,000

|

|

4

|

0.117

|

1,180,000

|

1,300,728

|

11.65

|

0.340

|

442,000

|

|

6

|

0.175

|

1,017,000

|

1,121,052

|

12.71

|

0.371

|

416,000

|

|

8

|

0.233

|

806,000

|

888,464

|

14.22

|

0.415

|

368,000

|

|

MEASURED PLUS INDICATED UNDILUTED RESOURCE

|

|

|

|

|

|

|

Cutoff Grade

|

Mineralized Tonnage

|

Average Grade

|

Contained Gold

|

|

(g/tonne)

|

(oz/ton)*

|

(tonnes)

|

(tons)

|

(g/tonne)

|

(oz/ton)

|

Au (oz)

|

|

|

|

|

|

|

|

|

|

2

|

0.058

|

1,670,000

|

1,840,861

|

10.62

|

0.310

|

570,000

|

|

4

|

0.117

|

1,510,000

|

1,664,491

|

11.42

|

0.333

|

555,000

|

|

6

|

0.175

|

1,288,000

|

1,419,778

|

12.54

|

0.366

|

519,000

|

|

8

|

0.233

|

1,009,000

|

1,112,233

|

14.08

|

0.411

|

457,000

|

|

INFERRED UNDILUTED RESOURCE

|

|

|

|

|

|

|

|

Cutoff Grade

|

Mineralized Tonnage

|

Average Grade

|

Contained Gold

|

|

(g/tonne)

|

(oz/ton)*

|

(tonnes)

|

(tons)

|

(g/tonne)

|

(oz/ton)

|

Au (oz)

|

|

|

|

|

|

|

|

|

|

2

|

0.058

|

2,060,000

|

2,270,763

|

10.5

|

0.307

|

697,000

|

|

4

|

0.117

|

1,925,000

|

2,121,951

|

11.0

|

0.322

|

683,000

|

|

6

|

0.175

|

1,628,000

|

1,794,564

|

12.2

|

0.354

|

636,000

|

|

8

|

0.233

|

1,340,000

|

1,477,098

|

13.3

|

0.387

|

571,000

|

* ton equals short dry ton

February 1, 2007: Canarc Reports Updated NI 43-101 Resource Estimate For New Polaris Gold Project, British Columbia

Gary Giroux, MASc., P.Eng. is the Qualified Person who prepared the NI 43-101 resource estimate set out above. The complete NI 43-101 report, titled "Resource Potential New Polaris", is available on SEDAR at www.sedar.com and was filed on March 16, 2007.

James Moors, B.Sc., P.Geo, Vice President, Exploration, is the Qualified Person responsible for the project quality assurance and quality control, infill drilling, and geological modelling on the New Polaris property.

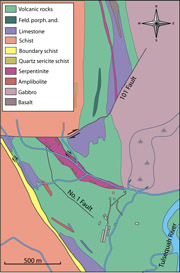

Geology and Gold Mineralization

Gold occurs in finely disseminated arsenopyrite that permeates the silica/sericite/fuchsite-altered wall rocks of almost barren quartz-carbonate veins. The white quartz-carbonate veins developed late in the mineralizing hydrothermal system and remobilized rare free gold into some late quartz/stibnite veins.

The mineralized veins are hosted within Paleozoic-aged mafic volcanic rocks and are developed along three principal vein sets adjacent to a major crustal break. Gold mineralization is late Cretaceous to Early Tertiary, and is very similar in terms of wallrock alteration, style of mineralization and host rock material to well-known Archean lode gold deposits such as Goldcorp's multi-million ounce Red Lake deposit.

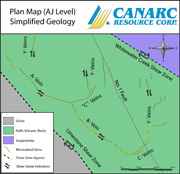

Gold mineralization occurs along three major vein sets:

1. AB shear veins - trending northwest/southeast,

2. Y extension veins - trending north/south,

3. C shear veins - trending east/west

C-veins generally link with the AB and with the Y veins at "junction arcs". Gold values within the veins show excellent continuity and uniformity, with very little nugget effect. Individual zones pinch, swell, and overlap en echelon. Width of gold mineralization ranges from 0.3 to 15 m in thickness, but tends to average about 3 m.

Metallurgy:

Historically, the mine operated at a rate of 200 tons per day. Ore was crushed through primary and secondary crushers, and ground in a ball mill. A standard flotation circuit was used to concentrate the ore prior to being shipped off site. Historical gold recoveries averaged 90% and concentrate grades ranged from 3.5 - 5.0 oz per ton gold.

Canarc performed extensive metallurgical test work that utilized flotation, cyanidation of the flotation tailings, and pressure oxidation (autoclaving) of the flotation concentrate. These tests achieved an average recovery of 94%. Additional metallurgical test work is planned to optimize the process.

Site Infrastructure:

Canarc constructed a new bunkhouse and dry at the New Polaris mine site and the camp is now capable of supporting 35 people. Several existing buildings have been refurbished and serve as both sleeping quarters and the kitchen facility. The machine shop has also been maintained as a maintenance facility.

Dislaimer

Cautionary Note to US Investors- The United States Securities and Exchange Commission limits disclosure for US reporting purposes to mineral deposits that a company can economically and legally extract or produce. We use certain terms on this web site, such as "reserves, " "resources," "geologic resources," "proven", "probable", "measured", "indicated," or "inferred," which may not be consistent with the reserve definitions established by the SEC. U.S investors are urged to consider closely the disclosure in our Form 20-F, File No. 000-18860. You can review and obtain copies of these filings from the SEC's website at www.sec.gov/edgar.shtml.

|

|

Follow Canarc

Follow Canarc